Government Incentives for Electric Vehicles

The push for cleaner, more sustainable transportation is gaining momentum, and government incentives for electric vehicles (EVs) play a significant role in this shift. These incentives make electric vehicles more affordable and attractive, encouraging more people to make the switch from traditional gasoline-powered cars to EVs. Governments around the world are offering a range of incentives to support this transition.

Why Government Incentives Are Important

Government incentives for electric vehicles are crucial for promoting the adoption of cleaner transportation. EVs generally have a higher upfront cost compared to conventional vehicles, mainly due to the cost of their batteries. To offset this, governments provide various incentives that reduce the financial burden on consumers.

These incentives not only help individuals save money but also contribute to broader environmental goals. By making electric vehicles more accessible, governments are helping to reduce greenhouse gas emissions and air pollution, which are major contributors to climate change and public health issues.

Types of Government Incentives for Electric Vehicles

There are several types of government incentives for electric vehicles. These incentives can vary widely depending on the country or region, but they generally fall into a few key categories.

Tax Credits and Rebates

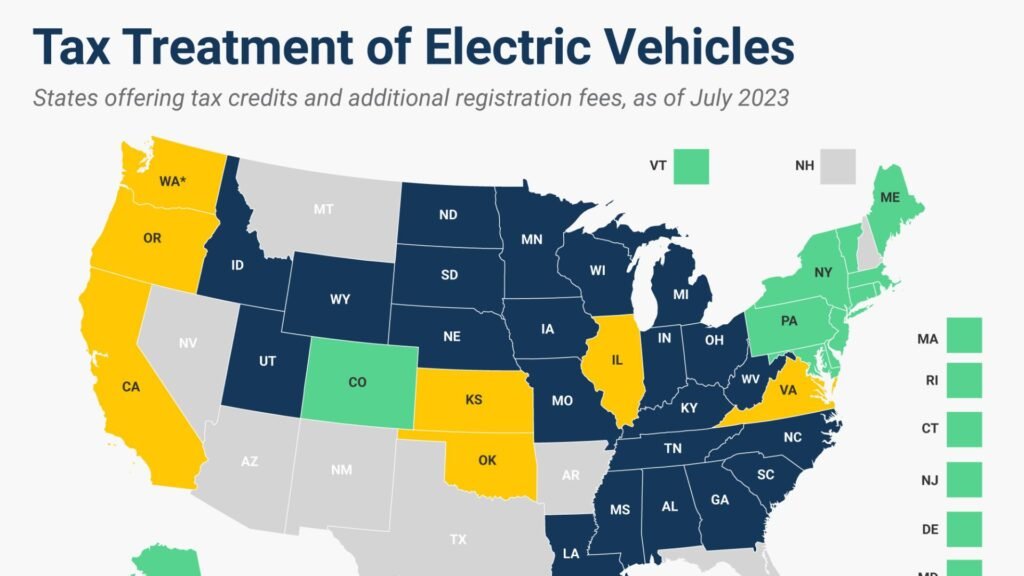

One of the most common incentives is the tax credit. In many countries, buyers of electric vehicles can receive a tax credit, which reduces the amount of income tax they owe. For example, in the United States, federal tax credits can range from $2,500 to $7,500, depending on the vehicle’s battery capacity.

Some governments also offer rebates, which provide a direct cash incentive at the time of purchase. These rebates can significantly lower the cost of an electric vehicle, making it more affordable for a wider range of consumers.

Reduced Registration Fees and Exemptions

Another popular incentive is the reduction or elimination of registration fees for electric vehicles. In some regions, EV owners pay lower annual registration fees compared to owners of gasoline-powered cars. In other areas, electric vehicles might be exempt from road taxes or congestion charges, further reducing the cost of ownership.

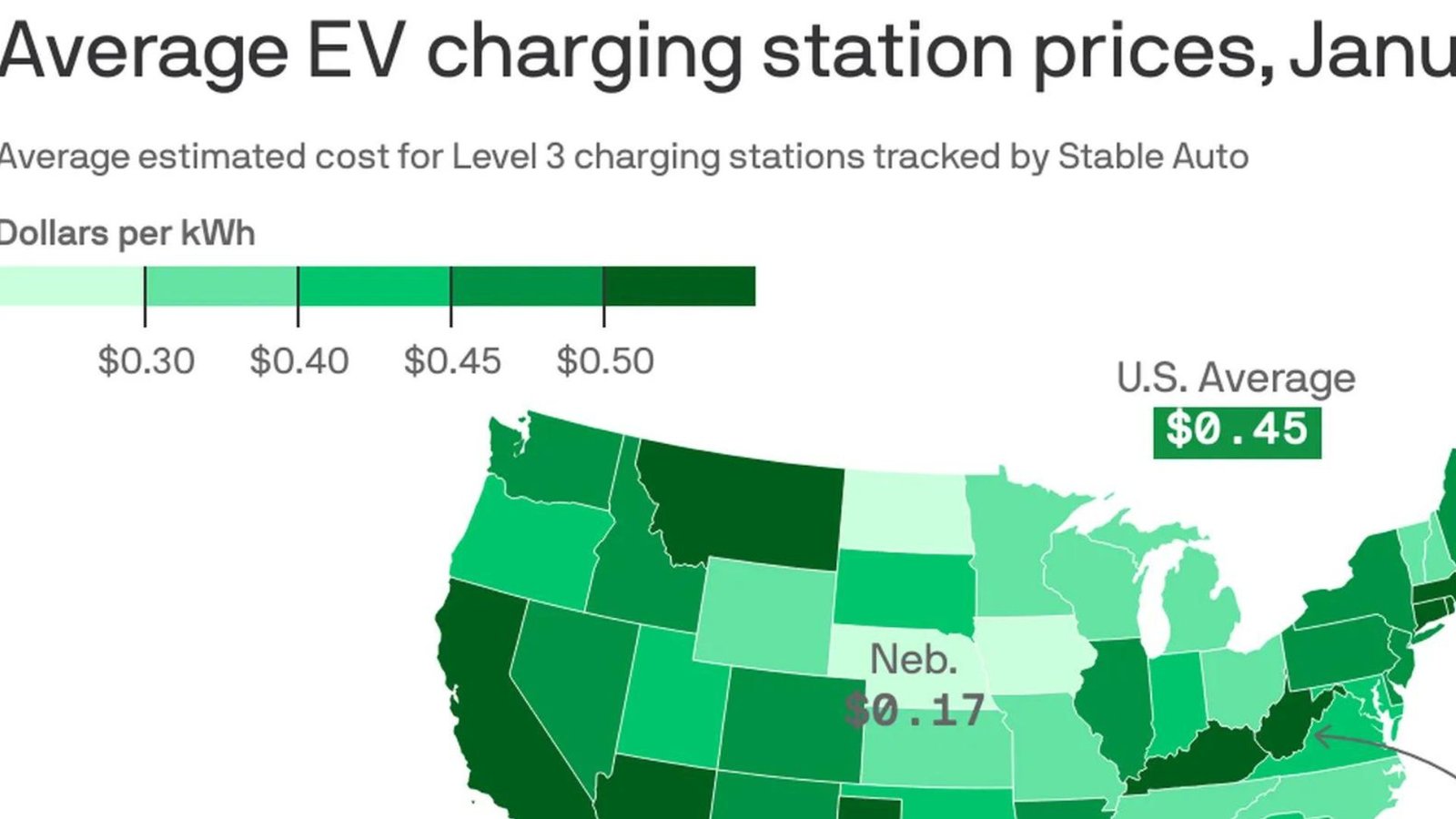

Grants and Subsidies for Charging Infrastructure

Governments also provide grants and subsidies to support the development of charging infrastructure. For instance, homeowners or businesses may receive financial assistance to install EV charging stations. By making charging more accessible, these incentives help alleviate one of the main concerns potential EV buyers have—range anxiety.

Incentives for Businesses and Fleets

Governments often extend incentives to businesses and fleets as well. Companies that purchase electric vehicles for their fleets may qualify for tax breaks or subsidies. Additionally, some governments offer grants to help businesses install charging stations on their premises, encouraging the use of electric vehicles in commercial settings.

The Role of Local Governments

In addition to national programs, local governments also play a significant role in promoting electric vehicles. Cities and states often offer their own incentives to complement federal programs.

Local Tax Incentives and Discounts

For example, some cities offer additional tax credits or rebates for EV buyers, on top of what is provided by the national government. Others provide discounts on tolls, parking fees, or allow electric vehicles to use carpool lanes, even with a single occupant. These local incentives make it even easier for residents to choose electric vehicles.

Support for Public Transportation Electrification

Local governments are also investing in the electrification of public transportation. By providing grants and subsidies to public transit agencies, cities can replace old, polluting buses with electric ones. This not only reduces emissions but also demonstrates the viability of electric vehicles in heavy-duty applications.

Challenges and Considerations

While government incentives for electric vehicles are highly effective, they are not without challenges. One issue is that these incentives can be expensive for governments to maintain, especially as EV adoption rates increase. Moreover, there is often debate over how these incentives should be funded and who should benefit from them.

Balancing Incentives with Market Growth

As the market for electric vehicles grows, some governments are beginning to phase out or reduce incentives. This raises concerns about whether the EV market can sustain itself without government support. However, as the cost of EVs continues to decline and technology improves, the need for incentives may decrease over time.

Conclusion

In conclusion, government incentives for electric vehicles are a powerful tool in promoting the adoption of clean transportation. By offering tax credits, rebates, and other financial benefits, governments are making electric vehicles more accessible to the public. These incentives are crucial for reducing emissions, improving air quality, and achieving global environmental goals. As the electric vehicle market continues to evolve, government incentives will likely adapt to ensure the ongoing success of this green transition.